Despite federal and state-level initiatives to support coal, the industry continues to shrink as utilities embrace alternative generation sources. The largest private coal company in the U.S., Murray Energy, filed for bankruptcy earlier this year in 2019. The end of Murray Energy was on par with the aggressive pace of coal retirements that have occurred throughout the years.

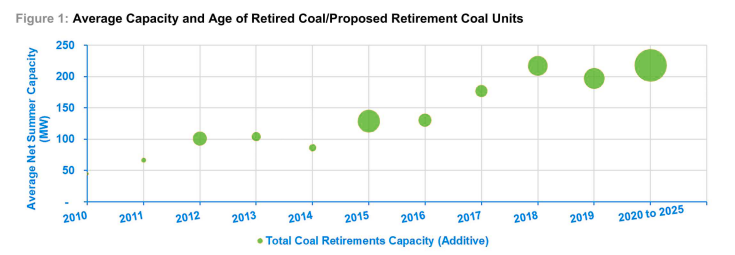

As seen above in Figure 1, the bubble sizes represent the total capacity pf coal retirements in the respective years. Coal units that retired after 2015 were larger and newer than those that retired before 2015. Courtesy of: NextEra Energy Resources

The pipeline of coal retirements continues to grow and forecasters indicate that between 2020 and 2025, a total of 20.8 GW of retirements is expected. On average, nearly 3.5 GW of coal will be retired every year during this time period.

The replacement of coal plants is driven by low gas prices, clean energy policies and stagnating power demand. In many markets where gas sets the marginal cost of power, power prices have been below the operating costs of the coal-fired plants. In resource planning, utilities are embracing new gas-fired plants and renewables due to their lower operating costs.

In the past year, five states – California, Connecticut, Massachusetts, New Jersey and New Mexico, and the District of Columbia raised their renewable portfolio standards (RPS) to 40 percent or more by 2030. Clean energy polices such as RPS programs could drive growth from new renewable resources and depress energy and capacity process for all types of generation technologies.

What Does This Mean for You?

This new standard will result in increased costs for compliance that will be passed through to consumers. How those costs will be charged may vary by individual supplier. Some may choose to include it in their fixed-price offer while others may elect to have it as a distinct pass-through charge. Because suppliers will handle this differently, it will be important to analyze each supplier price offer when getting bids to be sure you are comparing apples to apples. At Usource we do this analysis for our clients to ensure no unexpected or hidden charges hit their energy bills after contract signing.