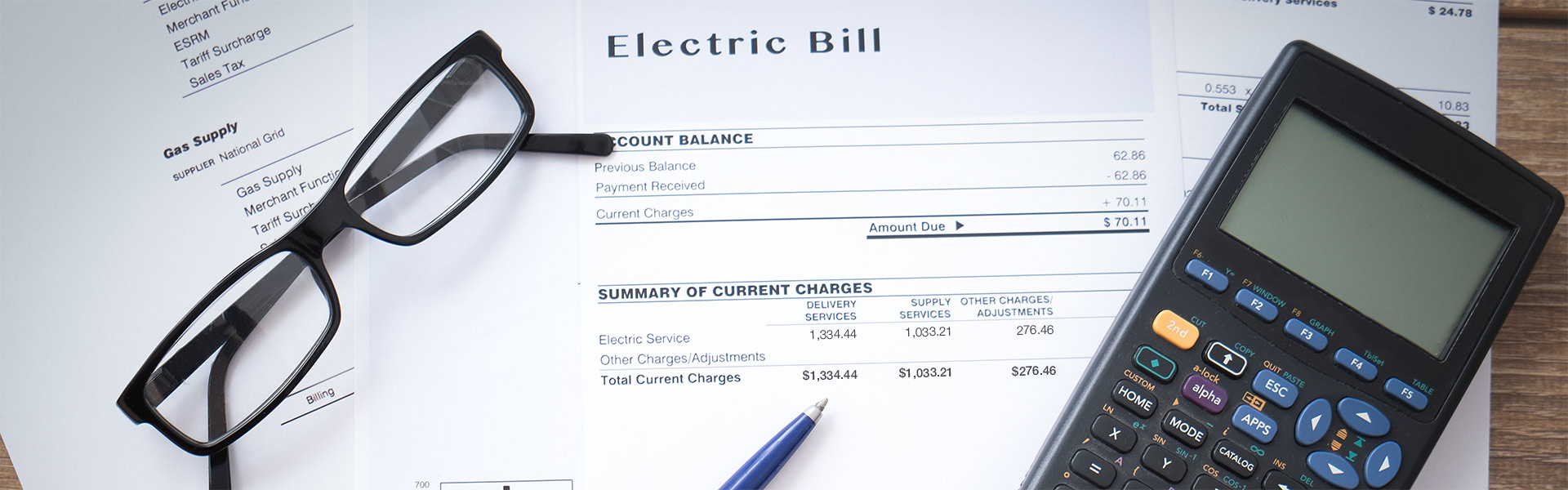

There may be costly errors in your utility bill

A free utility bill audit may uncover significant energy cost savings opportunities

Did you know that errors on your commercial energy bill could be costing you thousands of dollars every year? It’s not uncommon to have incorrect sales tax, capacity tag, transmission costs, rate codes, or supplier pass-through charges on your utility bills. Premier Power Solutions analysts are available to audit and analyze your commercial utility bill to correct errors and help you develop a cost-efficient energy procurement and energy management strategy. Complete the form below to request a utility bill audit.

Premier Power Solutions energy consultants are available to audit company utility bills and develop customized utility management solutions to meet your unique business objectives. The utility bill analysis is free and there are no upfront cost obligations. Any savings identified will be shared between Premier Power Solutions and your organization.

To request a utility bill analysis

-

Complete and submit the form to request a utility bill audit.

- An energy advisor will contact you to review the codes, taxes, and charges on your utility bill.

-

Should an error be discovered, we will then work with your local utility and/or supplier to correct the issues.